Competition

Perfect Competition

- Firms are in perfect competition when all three of the following occur

- Many firms produce identical products

- Many buyers are available to buy the product, and many sellers can sell the product.

- Sellers and buyers have all information to make rational decisions about the product. 1

- There is free entry and exit into and out of the market. Firms may enter or leave without restriction.

-

A price taker is a firm that is in perfect competition. Market pressures force price takers to sell at equilibrium price.

-

The product they produce will have perfectly elastic demand since price is fixed.

- Raising the price will mean consumers buy from other price takers.

- Lowering the price means temporary gains but eventually the rest of the market will follow and price will return to equilibrium.

Short Run Behavior

-

In the short run, firms seek the quantity where profits are maximized or losses are minimized

-

Under perfect competition, the marginal revenue of a firm does not change since price does not change. Marginal revenue is price.

-

The limiting factor to the quantity the firm sells is the increase in marginal cost from the Law of Diminishing Returns .

-

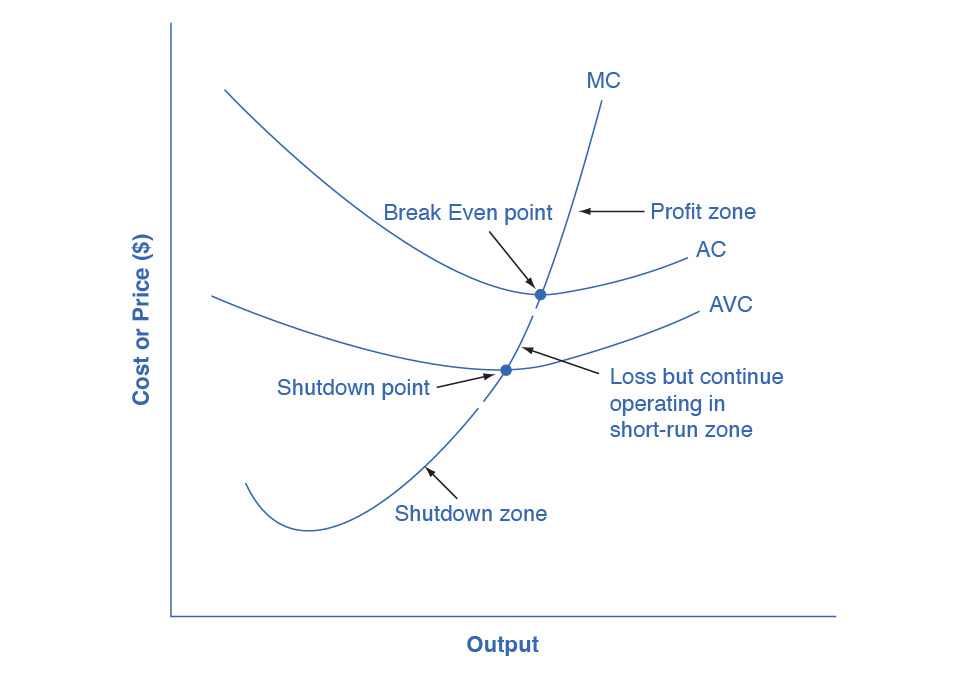

An economic profit happens if and only if market price is lower than average cost

- The break even point is the point when the market price is equal to the average cost. It dictates at least how much should be sold to not suffer a loss.

- In the case that there are multiple break even points, choose the break even point which minimizes losses.

-

The shutdown point is the point in which the average variable cost and the marginal cost are equal.

- If the market price is above the shutdown point, then it is paying for both its variable costs as well as some of its fixed costs. In this case, the firm should stay in business.

- If the market price is below the shutdown point, then it will incur even more losses due to the variable losses. It should, therefore shut down.

-

The marginal cost curve is identical to the firm’s supply curve starting from the minimum point on the average variable cost curve. This is also the curve that describes the production behavior of the firm when it is in business (i.e., not shut down)

Long Run Behavior

-

Entry pertains to new firms entering the industry in response to increased industry profits

-

Exit pertains to firms that cease production due to losses accrued in the long run. Firms exit because they cannot consistently make money

-

Entry and exit to and from the market are the driving forces behind a negative feedback loop towards an equilibrium point

-

In the long run, positive profits attract competition to the market which fuels a negative feedback loop as more firms = more supply = lower market price= lower profit

-

Losses cause firms below the shutdown point to leave. This fuels a negative feedback loop as less firms = less supply = higher market price = higher profit.

-

Equilibrium is achieved in the long run when no firm wants to enter or leave and when all firms have zero economic profit in the long run

-

-

Industries can be categorized based on the long-run behavior based on whether their costs increase, decrease or remain constant as demand increases.

- Constant Cost Industries have highly elastic supply curves and there is a perfectly elastic supply of inputs.

- Increasing Cost Industries have inelastic supply curves and limited inputs.

- Decreasing Cost Industries typically feature some form of innovation that drives cost down

- The Long Run Supply (LRS) curve is the curve formed from the long-run equilibria as supply and demand curve shift in response to an expanding market.

- Increasing Cost = positive sloping LRS curve = Shortage = Higher market price

- Constant Cost = constant slope LRS curve = Supply meets Demand = Same market price

- Decreasing Cost = negative sloping LRS curve = Surplus = Lower market price

-

Firms produce and sell goods at the lowest possible average cost. They are productive efficient.

-

Firms produce goods and sell them at a price equal to the social benefit of the good.

- The rule for allocative efficiency is that

- Producing less of the good means marginal costs will only decreases slightly 2 which means

. In such a case, clearly there is higher social benefit (price consumers are willing to pay) than social cost so firms will tend to produce more. - This arises because these firms are price takers and the price they set is equal to the price consumers are willing to pay (based on the equilibrium price).

- The rule for allocative efficiency is that

Monopoly

- A monopoly is a market where there is no competition. One firm produces all the output in the market. 3

- Monopolies are price makers because they can set the price (although still subject to the demand curve).

Barriers for Entry

-

Monopolies exploit different barriers to entry to prevent competitors from entering the market .

-

A high enough barrier for entry keeps competition away

-

Natural Monopoly - when economies of scale are large relative to the quantity demanded in the market

- Often arises when the marginal cost of adding an additional customer is very low, once fixed costs are in place.

- One large producer can serve the entire market more efficiently than many, smaller producers

- It can also arise because of local markets where goods are difficult to transport .

- The government often responds with regulation or ownership.

- It can also arise eventually due to [[details/creativity/design/DOET/Design Thinking#Standardization||Standardization]].

-

Control of a Physical Resource - when a company has control over a scarce physical resource.

-

Legal Monopoly - products where the government, themselves, prohibits or limits competition.

- These are typically utilities that are socially beneficial (so there is incentive to allow them to be regulated monopolies )

- They are often also subject to economies of scale.

-

Promoting Innovation - products that are protected due to government enforced intellectual property rights.

- IPs promote innovation because they guarantee that no competitor can exploit the innovation (and its associated labor costs) of a firm.

- Patent - gives the inventor the exclusive legal right to make use of or sell the invention for a limited time.

- Trademark - an identifying symbol or name for a particular brand.

- Copyright - work that cannot be reproduced or displayed without the author’s permission.

- Trade Secrets - even when a company does not have a patent on an invention, competing firms cannot steal their secrets.

-

Intimidating Potential Competition - tactics used by firms to discourage competitors from entering the market.

- Predatory pricing - an example of this tactic where the firm threatens to cut prices on the products so that competitors cannot make money.

- Advertising also serves as another example

- Governments may or may not intervene.

Dynamics

-

The challenge for monopolies is to choose the price and quantity to produce to maximize profits.

- Because of this a monopoly can see a negative revenue which comes from producing too many goods that they do not sell or being forced to sell the goods at a lower price.

-

The demand curve perceived by the monopoly is the actual market demand curve for their product.

-

A monopolist often has fairly reliable information about how changing output by small or moderate amounts will affect its marginal revenues and marginal costs, because it has had experience with such changes over time and because modest changes are easier to extrapolate from current experience 4

- The marginal revenue curve lies beneath the market demand curve since changing quantity will affect the price of all units produced prior.

- The firm decides by first selecting the quantity where

. Then it decides on price based on the perceived. demand curve.

-

Monopolies are inefficient because they do not supply enough output to be allocatively efficient

- They also do not produce at the minimum of the average cost curve.

- Monopolies are incentivized to produce less in order to charge a higher price which means

. - Compared to perfect competition, this comes because marginal revenue is not the same as the price the market is willing to pay.

- Monopolies are also not incentivized to innovate since they are the only suppliers of the product.

Monopolistic Competition

-

Monopolistic competition - feature a large number of competing forms but the products they sell are not identical. *When products are not distinctive, each firm has a monopoly on that distinct product

-

Firms in monopolistic competition sell differentiated products indicative of alternative styles of the product.

-

The perceived demand curve is in between that of perfect competition and a monopoly. Its dynamics fall between those two extremes

- With a price increase, it loses less than perfect competition but more than a monopoly .

- The firm’s decision process for deciding market price and quantity is similar to that of a monopoly. The difference is that the perceived demand curve is not the market demand curve.

- The perceived demand curve is influenced by the extent of differentiation.

-

Monopolistic Competition faces low barriers to entry. If the industry becomes profitable, more firms will enter the market.

- As more firms enter the market, the quantity demanded at a given price decreases.

- Conversely, as more firms leave the market, the quantity demanded at a given price increases

- This acts as a feedback loop that stabilizes towards zero economic profit in the long run 5

- The marginal revenue also shifts because for each quantity sold, the firm will charge a lower price (to keep up with demand).

- Monopolistic competition will not be productively efficient. It will not achieve the minimum average cost Like monopolies,

at equilibrium which means it is not allocatively efficient. The allocative inefficiency is smaller than that of a monopoly. - On the other hand, monopolistic competition encourages variety and product differentiation (i.e., innovation). However, it can be argued that it can lead to oversaturation of the market with unnecessary products or encouraging firms to do deceptive or predatory practices.

Oligopoly

-

Oligopoly - a small number of firms dominate the market.

- There is still a high barrier of entry, but at the same time opportunities for product differentiation.

- It may also arise naturally when quantity demanded cannot be met with just one firm — either because of insufficient production capabilities or because it wouldn’t be profitable due to selling a high quantity at a lower price

-

Oligopolies can act either like perfect competitors when they heavily compete or like monopolies when they collude

- Firms in an oligopoly can collude where they hold down the industry, charge a higher price, reduce output and keep prices high.

- A cartel is a group of firms in agreement to collude and behave like a monopoly — selling the monopoly quantity and the monopoly price.

- Firms tend to avoid competing to charge higher prices.

-

The perspectives from Game Theory are very much applicable here. Sometimes, firms will find themselves in situations where, due to maximizing their own utility given beliefs about the other firms, they do not achieve the Pareto optimal outcome, or an outcome that maximizes total welfare. To incentivize cooperation requires policies that change the firms’ payoffs for cooperative behavior.

-

Kinked demand curves are one measure whereby firms commit to match price cuts but not price increases . This forces firms to honor their commitments and acts as a form of self-enforcing behavior

- If the firm tries to increase its quantity sold, the other oligopolists will cut prices so that the firm is forced to (by the steep demand curve) also reduce prices.

- If the firm tries to raise its prices, the other oligopolists will not follow. This means that the firm will sell less since the other products in the industry are cheaper.

- The effect of the kinked demand curve is dependent on whether the sold goods are near identical. If the goods are near identical, the demand is more elastic.so the effect of the kinked demand curve is more drastic.

-

They have the trade-offs that come in place from monopolistic competition (suboptimal allocative efficiency and excessive social costs) and monopolies (lack of incentive for innovation)

Public Policy

-

The task of public policy with regard to competition is to attempt to encourage socially beneficial behavior and to discourage “greedy” behavior that benefits only a few while adding no corresponding social benefit to consumers.

-

A merger occurs when two formerly separate firms combine to form a single firm.

-

An acquisition is when a firm purchases another.

-

Mergers and Acquisitions can lead to monopolies.

-

Mergers are not necessarily good or bad. On one hand, they allow firms to operate more efficiently. On the other hand, they can lessen competition and lead to higher prices.

-

The concentration ratio pertains to the combined market share of the largest firms in an industry. This allows the detection of monopolies. Note that this does not consider cases where a monopoly contributes highly to the count.

-

Herfindahl-Hirschman Index (HHI) - it calculates the sum of squares of the market shares of each firm in the industry.

- Intuition: In a perfectly fair division of shares (with

firms), each firm would have share (which is exactly the HHI in this case).

- Intuition: In a perfectly fair division of shares (with

-

Both methods Assume (1) the market is well-defined — a highly defined market will naturally have seemingly higher “anti-competitiveness” and (2) a measure of competitiveness in the industry can be generalized to all industries.

- Both also do not measure competition directly, only the share occupied by each firm.

-

Another approach that is more empirical is to estimate the demand and supply curves as well as model how competition will take place. A model is then made to see the effects of a merger.

-

The government has antitrust laws which prevent the rise of a monopoly by breaking large firms into smaller ones. This aims to increase allocative efficiency and promote innovation

- Antitrust laws have rules against restrictive practices which do not involve agreements to raise prices but will affect competition regardless. This requires discretion on a case to case basis depending on established intent.

- Exclusive dealing - a manufacturer agrees to only sell to a specific dealer.

- Tying sales - a customer is only allowed to buy one product after also buying a second product.

- Bundling - a firm sells two or more products as one. It typically favors consumers since they acquire multiple products for a better price.

- Predatory Pricing Practices - a firm lowers prices to establish a barrier for entry.

- Antitrust laws have rules against restrictive practices which do not involve agreements to raise prices but will affect competition regardless. This requires discretion on a case to case basis depending on established intent.

-

Natural monopolies can be regulated in a few ways:

- Not at all, in which case the monopoly operates as is

- Divide the firm so new firms can compete

- Regulators set prices and quantities produced for the industry. .

- Cost plus regulation - use the average cost of production and add an amount for the normal rate of profit, just enough to prevent abnormally high monopolistic profits

- Price cap regulation - set a price that the firm can charge over the next few years, requiring that price decline slightly over time. This incentivizes cost-saving innovations.

-

A counterbalance to regulation is rule beating where firms try to bypass regulation

-

Deregulation is equally as bad, however, when it causes a drift to low performance through regulatory capture - where the firms that are regulated also have a large role in setting the regulations.

- This may end up exerting more competitive pressure which makes the market volatile.

Links

Footnotes

-

This alone makes perfect competition an ideal since complete information is almost certainly an impossibility in the real world. ↩

-

A sort of reverse Law of Diminishing Returns ↩

-

In practice, it still applies if the firm has a very high market share. Although, the distinction on what constitutes a monopoly in the market depends on if we consider substitutes. ↩

-

Not unlike Gradient Descent. ↩

-

Arguably, though, firms will never reach long-term equilibrium because (1) the market is constantly innovating; (2) advertising campaigns can drum up artificial demand to varying degrees of success; and (3) consumer preferences change. All of these mean that the market never settles down in equilibrium ↩